Citi Business Credit Cards offers numerous benefits to its cardholders, you too can be a beneficiary, and it has no limitations like other Business Credit Cards. This card will relieve your company’s stress from managing business transactions and expenses. Choosing the right Business Credit cards for your business will impact your business positively. Citi is a renowned financial institution in the USA and offers various Business Credit cards designed to meet diverse business transaction needs. These cards provide valuable rewards, benefits and financial tools that will help you to scale up, manage and expand your business operations. Chase Business Credit Cards

As a business owner, managing finances and expenses can be a huge task that requires personal discipline and good accounting knowledge. However, with the right tools and credit card options, you can modernize your financial management and take your business to a high level.

In this blog post, we will explain the benefits and features of Citi Business Credit Cards, helping you make informed decisions about your business finances.

Types of Citi Business Credit Cards

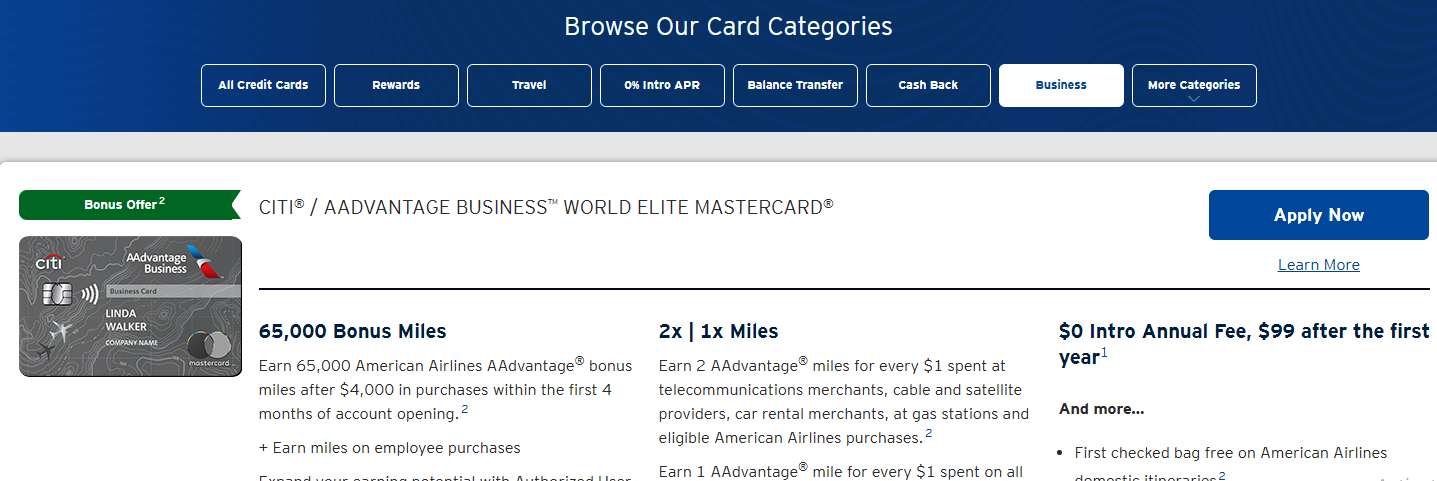

Citi has a range of business credit cards designed for different categories of business. The good news is that these cards are moulded to meet different business transaction needs. That means no matter the type or size of your business you will have access to Citi business credit cards that will serve your company. Below is a comprehensive list of Citi Cards:-

- CitiBusiness® / AAdvantage® Platinum Select® Mastercard®

- Perfect for frequent travellers.

- Rack up American Airlines AAdvantage® miles on everyday business purchases.

- CitiBusiness® ThankYou® Card

- Great for earning flexible ThankYou® points.

- Use points for travel, merchandise, gift cards, and more.

- CitiBusiness® Card

- A solid choice with essential business benefits.

- Handy for managing business expenses.

Comparing Citi Business Credit Cards

Not sure which Citi business credit card is right for you? Let’s compare:

CitiBusiness® / AAdvantage® Platinum Select® Mastercard®

- Best For: Frequent flyers.

- Rewards: Earn AAdvantage® miles on every purchase, double miles on American Airlines purchases.

- Perks: Free checked bags, priority boarding, and in-flight discounts.

CitiBusiness® ThankYou® Card

- Versatile rewards.

- Rewards: Earn ThankYou® points on all purchases, with bonus points in select categories.

- Perks: No annual fee, points transfer to travel partners.

CitiBusiness® Card

- Best For: Basic rewards without the frills.

- Rewards: Earn points on purchases, with flexible redemption options.

- Perks: Simple rewards structure for everyday expenses.

Why Choose Citi Business Credit Cards?

Citi business credit cards offer a range of benefits and features designed to meet the unique needs of business owners. With Citi, you can enjoy swift business transactions; you don’t need to border your head over your business dealings daily. Ramp Credit Card

Flexible Rewards Programs: Earn points or cashback on your purchases, with flexible redemption options.

Expense Management Tools: Track and manage expenses with ease, using Citi’s online platform or mobile app.

Employee Card Management: Add employee cards with customizable spending limits and restrictions.

Credit Limits: Enjoy higher credit limits to accommodate your business needs.

Travel Benefits: Access travel insurance, concierge services, and airport lounge access with select cards.

Purchase Protection: Get protection against unauthorized purchases and extended warranties.

Citi Business Credit Cards Login

Managing your Citi business credit card online is simple and convenient. Below are the steps on how to log in and access your Citi card:

Step 1. Visit the Citi website and navigate to the business credit cards section.

- Alternatively, use this direct link: Citi Business Credit Cards Login.

Step 2. Input your User ID and Password.

- If you’re a first-time user, click on “Register” or “Activate a Card” to set up your account.

Step 3: Once logged in, you can view your account summary, check your balance, pay your bill, and manage other account features.

Tips for Secure Login:

- Always use a secure and private network when accessing your account.

- Enable two-factor authentication for added security.

- Regularly update your password and keep it confidential.

Citi Business Credit Card Requirements

To qualify for a Citi business credit card, you will need to provide the under-listed information.

Business Information: You’ll need to provide details about your business, such as:

- Business name and address

- Type of business (LLC, Corporation, Sole Proprietorship, etc.)

- Years in business

- Number of employees

- Annual revenue

Personal Information: Even though it’s a business credit card, your personal credit history will be considered. You’ll need to provide:

- Your name, address, and Social Security number

- Personal income information

Credit Score: A good to excellent personal credit score is typically required. This means a score of 670 or higher.

Business Financials: You might be asked for additional documentation to prove your business’s financial stability, such as:

- Tax returns

- Bank statements

- Profit and loss statements

Personal Guarantee: Most business credit cards, including those from Citi, require a personal guarantee. This means you’ll be personally responsible for the debt if the business can’t pay.

How to Choose the Right Citi Business Credit Card

Choosing the right card depends on your business needs:

- Business Size: Larger businesses with significant travel expenses might benefit from travel rewards cards, while smaller businesses may prefer cash back or general rewards.

- Spending Habits: Analyze where your business spends the most (travel, office supplies, dining) to choose a card that maximizes rewards in those categories.

- Financial Goals: Consider whether you want to earn travel points, cash back, or flexible rewards like ThankYou® points. Top Best Opportunities in Nigeria

Tips for Maximizing Benefits:

- Use the card for all business-related purchases to maximize rewards.

- Take advantage of introductory offers by meeting spending thresholds.

- Utilize expense management tools to streamline financial tracking.

Credit Limit for Citi Business Credit Cards

The credit limit for Citi business credit cards varies based on several factors, including:

- Higher business revenue can lead to a higher credit limit.

- Both your personal and business credit scores will influence the limit.

- Strong financial statements, including cash flow and profitability, can positively impact your credit limit.

- A solid credit history with timely payments and low debt levels will be favourable.

While specific credit limits are not publicly disclosed by Citi, businesses with strong financials and credit profiles can expect higher credit limits. It’s best to apply and review the credit limit offered based on your unique business circumstances.

Application Process and Tips for Approval

Applying for a Citi business credit card is straightforward:

- Have your business details, financial information, and personal details ready.

- Select the Citi business credit card that best fits your needs.

- Visit the Citi website and fill out the application form.

Tips for Improving Approval Chances:

- Ensure your personal and business credit scores are in good standing.

- Double-check all information before applying.

- Show proof of steady income and business stability.

Citi business credit cards offer a range of benefits and their features are designed to meet the unique needs of business owners. It comes with flexible rewards programs, expense management tools, and employee card management.

Choosing the right Citi business credit card can provide valuable rewards, financial tools, and perks that support your business’s growth and financial health. By understanding the features and benefits of each card, comparing options, and considering your business’s specific needs, you can select the card that best aligns with your goals. Take the next step in maximizing your business potential with a Citi business credit card tailored to your needs.