The Wells Fargo Credit Card Business is designed to help you smoothly conduct your business transactions. With this card, you can easily manage your expenses and business transactions, even if you don’t have a strong accounting background. It simplifies and organizes your business transactions, and you can choose from a wide variety of cards offered by the company. Citi Business Cards

Wells Fargo, established in 1852, is one of the most prominent financial institutions in the United States. With a broad range of services that encompass banking, investments, and mortgages. Wells Fargo also offers an extensive lineup of credit cards designed to meet the diverse needs of its customers.

This blog post provides a thorough exploration of Wells Fargo’s credit card business, highlighting the various options available, their features, benefits, and their impact on consumers.

Wells Fargo Credit Cards

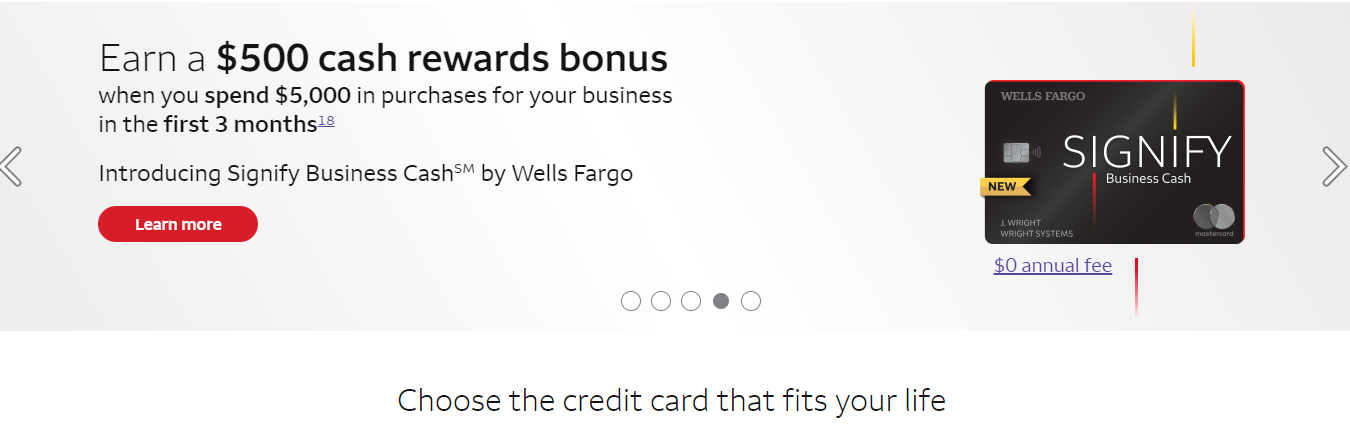

Wells Fargo offers several credit cards, each tailored to suit different business transactions and expense management needs. Let’s take a look at some of their most popular cards

- Wells Fargo Active Cash℠ Card

- Wells Fargo Reflect℠ Card

- Wells Fargo Autograph℠ Card

- Wells Fargo Business Platinum Credit Card

Key Features and Benefits

Wells Fargo Active Cash℠ Card

- Offers unlimited 2% cash back on all purchases, making it ideal for everyday spending without the need to track categories.

- 0% APR on purchases and qualifying balance transfers for the first 15 months.

- No annual fee.

Wells Fargo Reflect℠ Card

- Up to 21 months of 0% APR on purchases and balance transfers, providing a long period to pay off large purchases or consolidate debt.

- Although not primarily a rewards card, it offers useful features for managing finances.

- No annual fee.

Wells Fargo Autograph℠ Card

- Earn 3X points on categories such as travel, dining, gas stations, transit, and popular streaming services.

- 0% APR for the first 12 months on purchases.

- No annual fee.

Wells Fargo Business Platinum Credit Card

- Offers 1.5% cash back on every $1 spent, with no category restrictions.

- 0% APR for the first nine months on purchases and balance transfers.

- No annual fee.

Security Features

Wells Fargo credit cards come with robust security features to protect customers:

- Zero Liability Protection: Cardholders are not responsible for unauthorized transactions.

- Fraud Monitoring: Continuous monitoring of accounts for suspicious activity.

- Chip Technology: Enhanced security for in-person transactions.

Mobile and Online Banking

Wells Fargo provides an excellent digital experience through its mobile and online banking platforms. Cardholders can easily manage their accounts, track spending, set up alerts, and make payments securely. Features such as the ability to lock and unlock cards add an extra layer of security and convenience. Chase Business Credit Cards

How to Sign In to Your Wells Fargo Credit Card

Visit the Wells Fargo Website

- Open your web browser and go to the Wells Fargo homepage.

Access the Sign-In Page

- On the homepage, locate the “Sign On” button in the upper right corner and click on it.

Enter Your Credentials

- You will be redirected to the login page. Enter your username and password in the respective fields.

Complete the Security Check

- Wells Fargo may prompt you to complete a security check for added protection. Follow the on-screen instructions.

Click “Sign On”

- After entering your credentials and completing any required security checks, click the “Sign On” button to access your account.

Navigate to Your Credit Card Account

- Once signed in, you can navigate to your credit card account from the main dashboard. Here, you can view statements, make payments, and manage your account settings.

Wells Fargo Credit Card Customer Service

Wells Fargo offers multiple ways to contact customer service for assistance with your credit card account.

Customer Service Phone Numbers

- General Customer Service: For general inquiries and assistance with your credit card, you can call 1-800-869-3557.

- Credit Card-Specific Inquiries: For issues specifically related to your credit card, call 1-800-642-4720.

- Lost or Stolen Cards: If your card is lost or stolen, immediately call 1-800-869-3557 to report it and prevent unauthorized use.

Tips for Managing Your Wells Fargo Credit Card

- Set Up Account Alerts: Enroll in account alerts to receive notifications about due dates, transactions, and suspicious activity.

- Enrol in AutoPay: Set up automatic payments to ensure you never miss a payment and avoid late fees.

- Monitor Your Credit Score: Many Wells Fargo credit cards offer free access to your FICO credit score. Regularly monitoring your score can help you stay on top of your credit health.

Wells Fargo Credit Card Pre-Approval

Pre-approval for a Wells Fargo credit card is a process where the bank evaluates your creditworthiness using a soft credit check, which does not impact your credit score. If you qualify, you’ll receive an offer indicating that you have a high likelihood of being approved for a specific credit card.

How to Check for Pre-Approval

Visit the Wells Fargo Website

- Go to the Wells Fargo Credit Card Pre-Approval page.

Provide Information

- Enter your personal information, including your name, address, and the last four digits of your Social Security number.

Submit Your Request

- Submit the form to see if you are pre-approved for any Wells Fargo credit cards.

Review Offers

- If pre-approved, you’ll see a list of credit card offers tailored to your financial profile.

Wells Fargo Secured Credit Card

- Credit Limit: Your credit limit is equal to the amount of your security deposit, ranging from $300 to $10,000.

- Credit Reporting: Wells Fargo reports your payment history to the major credit bureaus, helping you build your credit.

- Upgrade Potential: With responsible use, you may be able to upgrade to an unsecured Wells Fargo credit card in the future.

Wells Fargo Credit Card Payment Options

Wells Fargo offers several convenient methods for paying your credit card bill:

Online Payments

- Log in to your Wells Fargo online account and navigate to the “Transfer & Pay” section to make a payment.

Mobile App

- Use the Wells Fargo mobile app to pay your credit card bill on the go. The app is available for both iOS and Android devices.

Automatic Payments

- Set up AutoPay to have your credit card payments automatically deducted from your Wells Fargo checking or savings account each month.

Phone Payments

- Call the Wells Fargo credit card customer service number at 1-800-869-3557 to make a payment over the phone.

In-Person Payments

- Visit any Wells Fargo branch to make a payment in person.

Mail Payments

- Send your payment by mail to the address listed on your billing statement.

Wells Fargo Cash Back Credit Cards

Wells Fargo Active Cash℠ Card

The Wells Fargo Active Cash℠ Card is a popular option for those seeking cash-back rewards. Here are its key features:

- Earn 2% cash back on all purchases with no category restrictions.

- 0% APR on purchases and qualifying balance transfers for the first 15 months.

- Enjoy the benefits without an annual fee.

Wells Fargo Autograph℠ Card

For those looking for a card that offers points on specific categories, the Wells Fargo Autograph℠ Card is an excellent choice:

- Earn 3X points on travel, dining, gas stations, transit, and streaming services.

- Earn 1X points on all other purchases.

- This card also comes with no annual fee, making it a cost-effective option.

Wells Fargo Credit Card Application

Visit the Wells Fargo website and choose the desired card to apply online.

Visit a Wells Fargo branch for in-person assistance with your application.

Call Wells Fargo customer service to apply over the phone.

Wells Fargo offers a variety of credit cards to meet diverse financial needs. Similarly, whether you are looking for cash-back rewards, building credit, or need help with your application process, understanding the features and services provided can help you make the best choice for your financial goals.