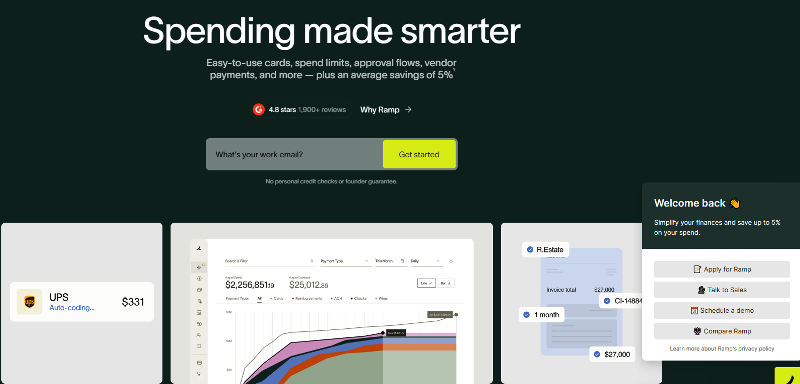

Ramp Card is a tool that helps in managing expenses. Managing business expenses can be tedious and time-consuming, However, with the advent of the Ramp Card, corporate bodies and companies can now streamline their spending, enjoy rewards, and simplify their financial management.

In this blog post, we will explain the features, benefits, and advantages of Ramp Card, and how it’s revolutionizing the way businesses approach expense management. Business Credit Card in the USA

The Problem with Traditional Corporate Cards

Traditional corporate cards often come with fees, interest, and limited rewards. They also lack real-time tracking and reporting capabilities, making it difficult for businesses to stay on top of their expenses. This can lead to inefficiencies, wasted resources, and a lack of financial visibility.

What is a Ramp Card?

A Ramp Card is a cutting-edge corporate card and expense management platform designed to streamline business expenses and simplify your financial life. With Ramp Card, you can say goodbye to tedious expense tracking and hello to a more efficient, more organized way of managing your business spending.

Ramp Card Requirements

To apply for a Ramp Card, your business must meet certain requirements. In this post, we’ll outline the necessary criteria to help you determine if your business is eligible.

Incorporated Entity

Your business must be an incorporated entity, such as a:

- Corporation (C-Corp or S-Corp)

- Limited Liability Company (LLC)

- Limited Partnership (LP)

Registered in the United States

Your business must be registered in the United States and have a physical presence in the country.

Minimum Cash Balance

Your business must have at least $50,000 to $75,000 in cash in a U.S. business bank account. This requirement may vary depending on your business size and industry.

U.S. Operations and Spend

Your business must have most of its operations and corporate spending in the United States.

Employer Identification Number (EIN)

You must have an Employer Identification Number (EIN) issued by the IRS.

Business Formation Documents

You must have business formation documents, including:

- Articles of Incorporation (for corporations)

- Articles of Organization (for LLCs)

- Partnership Agreement (for LPs)

Business Email Address

You must have a business email address on a company domain.

Bank Account Login Credentials

You must have login credentials to link your business bank account to Ramp Card.

Personal Identification

You must have the last four digits of your Social Security Number (SSN) or a foreign passport and proof of address if you don’t have an SSN.

Ramp Card Review

In today’s fast-paced business landscape, managing expenses can be a huge task. From tracking receipts to reconciling accounts, the process can be time-consuming and prone to errors. That’s where the Ramp Card comes in.

This Card offers a range of innovative features that set it apart from traditional corporate cards. These include:-

- Unlimited 1.5% cash back on all purchases.

- No fees or interest.

- Real-time expense tracking and reporting.

- Customizable spending limits and approvals.

- Integration with accounting software like QuickBooks and Xero.

- Mobile app for easy expense tracking and receipt upload.

- Virtual cards for online purchases.

- Physical cards for in-person purchases.

Ramp Card Benefits

Customers who use Ramp Card for businesses can enjoy a range of benefits,

- Simplified expense management.

- Enhanced financial visibility and control.

- Reduced administrative burdens.

- Rewards and benefits tailored to business needs.

- A secure and transparent platform for business spending

Advantages

The Card offers several advantages over traditional corporate cards,

- Easy to use and implement.

- Scalable for businesses of all sizes.

- Real-time tracking and reporting.

- Integration with existing accounting software.

- Customizable spending limits and approvals

Use Cases

The Card is ideal for businesses of all sizes and industries,

- Scaling startups looking to optimize expense management.

- Remote teams need streamlined expense tracking.

- Entrepreneurs seeking rewards and benefits on business purchases.

How Does Ramp Card Work?

Ramp Card offers a range of innovative features that make expense management a breeze. Here are just a few of the benefits you can expect:

- Real-time expense tracking: Easily track your expenses in real-time, with automatic categorization and receipt upload.

- Customizable spending limits: Set limits on spending for individual employees or departments, and receive alerts when those limits are reached.

- Integration with accounting software: Seamlessly integrate with popular accounting software like QuickBooks and Xero.

- Mobile app: Access your Ramp Card account on the go with our mobile app.

- Rewards and benefits: Earn rewards and benefits on your business purchases. Nova University Tuition Fees

Who Can Benefit from Ramp Cards?

Ramp Card is perfect for businesses of all sizes and industries, including:

- Scaling startups: Streamline your expense management as your business grows.

- Remote teams: Easily track expenses and manage spending for remote employees.

- Entrepreneurs: Simplify your expense management and earn rewards on your business purchases.

How to Activate Ramp Card

This is a complete guide on how to activate your Ramp card is a quick and easy process that can be done in just a few steps.

Step 1: Create an Account.

To activate your Card, you’ll need to create an account on the Ramp website. Simply go to the Ramp website and click on “Sign Up” in the top right corner. Fill out the registration form with your business information and click “Submit”.

Step 2: Verify Your Information.

Once you’ve created your account, you’ll need to verify your information. Ramp will send a verification email to the email address you provided. Click on the link in the email to confirm your email address.

Step 3: Activate Your Card

After verifying your information, you can activate your Card. Log in to your Ramp account and click on the “Activate Card” button. Enter the required information, including your card number, expiration date, and security code.

Step 4: Set Up Your PIN

Once your card is activated, you’ll need to set up a PIN. This will help keep your card secure and prevent unauthorized use. To set up your PIN, log in to your Ramp account and click on the “Set PIN” button. Follow the prompts to create a unique PIN.

Step 5: Start Using Your Card

That’s it! Your Card is now activated and ready to use. You can start using your card to make purchases, track expenses, and earn rewards.

Tips and Tricks

- Make sure to sign the back of your card to prevent unauthorized use.

- Keep your card safe and secure to prevent loss or theft.

- Use your Ramp Card for all your business purchases to earn rewards and track expenses.

Ramp Card App

The Ramp Card app is a cutting-edge corporate expense management tool that allows you to manage your Ramp Card straight from your mobile device. With the app, you can easily view and lock your cards, add your card to Google Pay or Apple Wallet, request new spending or temporary spending increases, and so much more. John F. Kennedy Scholarship

The Ramp card will help you to:

- View and lock your cards.

- Add your card to Google Pay or Apple Wallet.

- Request new spending or temporary spending increases.

- Take pictures of receipts and auto-match them to transactions.

- Submit additional requirements like memos and accounting fields.

- Request reimbursements.

- View all transactions and spend requests.

- See your expense policy.

- Set communication preferences.

- Switch between Ramp accounts if you have multiple instances.